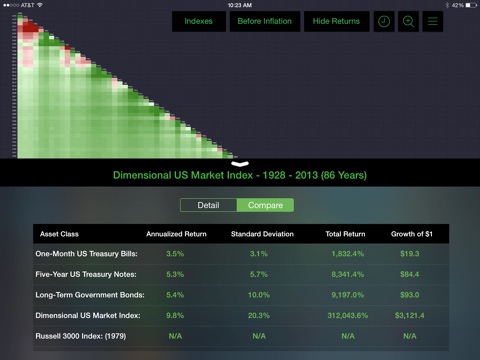

The Index Matrix is a unique, easy-to-use, and engaging visual perspective on the long-term performance history of the U.S. stock market, inflation, short-term, intermediate-term, and long-term U.S. Treasury securities.

Using an interactive “heat map” perspective, the Index Matrix shows the extremes of short-term performance in clear contrast to the moderation of returns over progressively longer periods.

Users may chose any period between 1928-2013 for a core set of U.S. market indexes and inflation. The Index Matrix can show either before inflation (nominal) or after inflation (real) returns. Comparisons of total return, annual return, standard deviation, and growth of $1.00 for all other indexes in the matrix are also shown. Users can zoom in and zoom out of the Index Matrix to view specific periods in U.S. stock market history.

The Index Matrix is an outstanding educational tool. Investment advisors can use the index matrix to help develop more realistic risk/return expectations based on an investor’s unique investment time horizon.

The Index Matrix includes the following U.S. indexes (start year):

• US Consumer Price Index (1928)

• One-Month US Treasury Bills (1928)

• Five-Year US Treasury Notes (1928)

• Long-Term US Government Bonds (1928)

• Dimensional US Market Index (1928)

• Russell 3000 Index (1979)

• Dimensional US Large Cap Index (1928)

• Russell 1000 Index (1979)

• Dimensional US Large Cap High Price-to-Book Index (1928)

• Dimensional US Large Cap Growth Index (1975)

• Russell 1000 Growth Index (1979)

• Dimensional US Large Cap Value Index (1928)

• Russell 1000 Value Index (1979)

• Dimensional US Small Cap Index (1928)

• Russell 2000 Index (1979)

• Dimensional US Micro Cap Index (1928)

• Dimensional US Small Cap High Price-to-Book Index (1928)

• Dimensional US Small Cap Growth Index (1975)

• Russell 2000 Growth Index (1979)

• Dimensional US Small Cap Value Index (1928)

• Russell 2000 Value Index (1979)

Index data provided by Dimensional Fund Advisors (DFA) and Russell Investments.

The Index Matrix was developed by Asset Class Investing, Inc., a firm dedicated to informing long-term investors of the benefits of “passive” investment strategies, such as indexing and asset class investing.

We value and respond to feedback! If you have feedback or app issues please email us at [email protected].